Memorandum

Date: September 12, 2013

To: Boston Region MPO

From: William Kuttner

MPO Staff

Re: Proposed Freight Planning Action Plan for the Boston Region MPO: Meeting the Goals and Addressing the Issues

Recognizing the importance of freight transportation and the unique challenges that a comprehensive freight analysis entails, the Boston Region Metropolitan Planning Organization (MPO) wishes to establish a formal freight-planning program starting in federal fiscal year (FFY) 2014. The MPO anticipates that freight analysis within the framework of this program would be ongoing, and conducted on a multiyear basis. To this end, staff was directed to develop an “action plan” for this program that would further the MPO’s freight-planning goals.

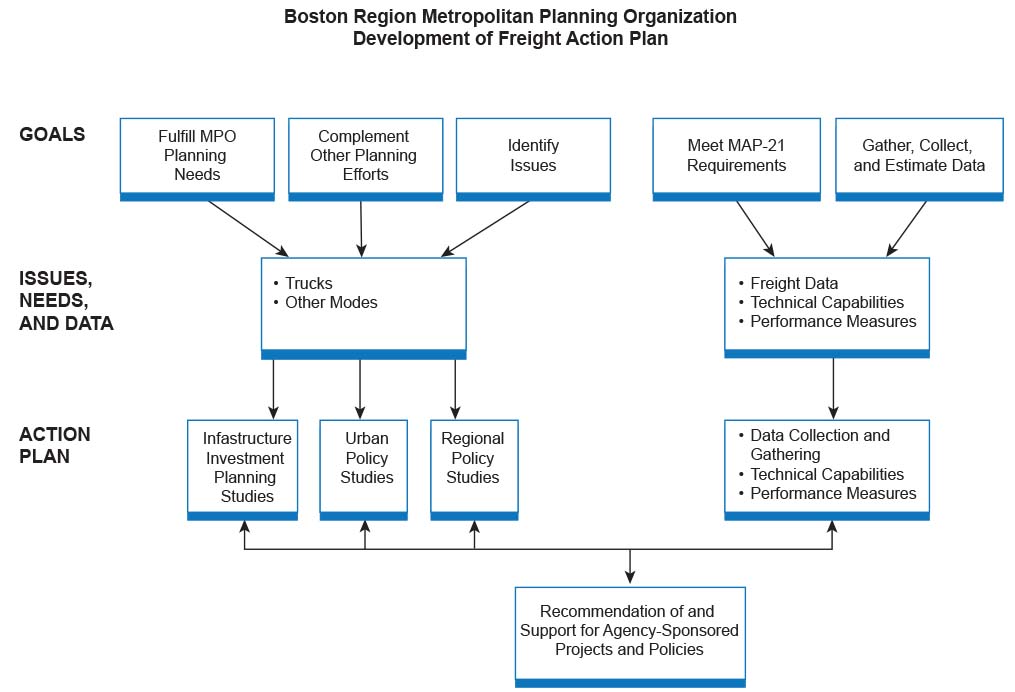

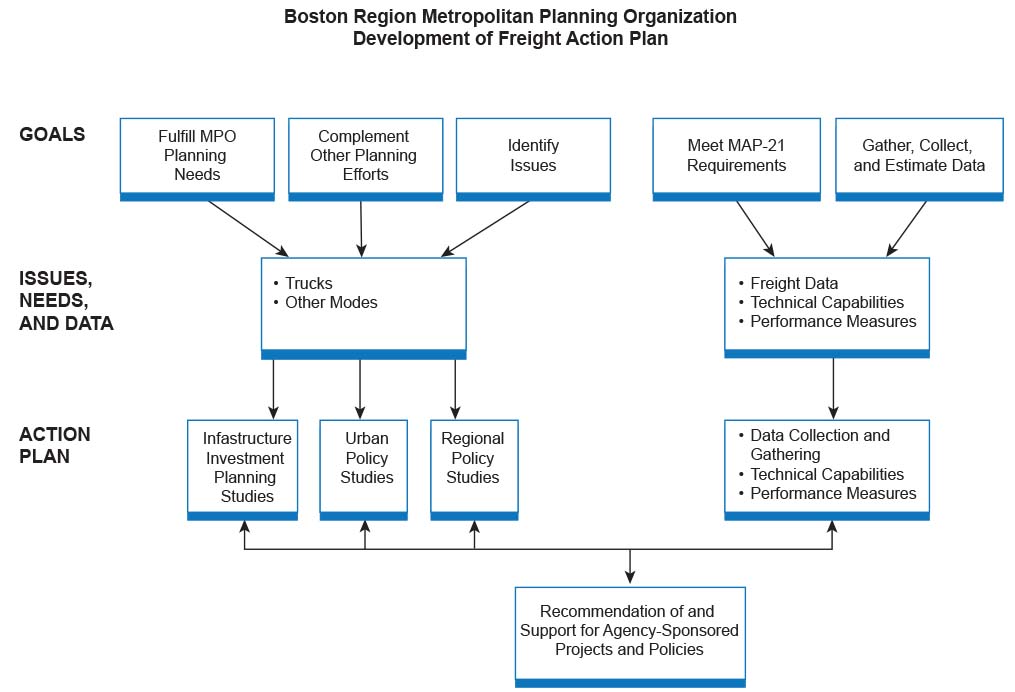

The efforts recommended for the action plan share several characteristics. They 1) deal with significant amounts of freight activity that affect the MPO, 2) are feasible, and 3) are within the capabilities of MPO staff. Furthermore, they are within the context of statewide Massachusetts Department of Transportation (MassDOT) freight focus areas, and the guidance of federal agencies. More specifically, the recommended efforts advance one or more of the following five broad freight-planning goals identified by MPO staff:

Over the years, MPO staff has done freight-related work within these five goals, including preparing regional planning documents, evaluating freight issues in these documents, preparing topical studies requested by the MPO, and conducting studies requested by implementing agencies. This memorandum envisions an MPO freight program in which efforts under these four goals would be mutually supportive; and in which findings and data developed in support of one goal would be utilized to expand upon and improve work towards the other three goals. Establishing freight analysis as a multi-year effort would facilitate this type of study integration.

The starting point for this memorandum is the Massachusetts Freight Plan2 (Freight Plan), which provides an overview of current and projected freight movements in Massachusetts. Using statewide freight tonnage as a reference point, some comparisons with freight in the Boston Region MPO area are discussed. The Freight Plan also supplies the key freight findings in the Boston MPO Long-Range Transportation Plan: Paths to a Sustainable Region3.

The next section of this paper discusses federally mandated freight planning, including anticipated new performance measurements required by MAP-21. The MAP‑21 freight requirements are still under consideration; a major concern among MPO and state administrators for meeting the MAP-21 requirements is the general lack of freight data at a useful level of detail. The appropriateness of the Boston Region MPO focusing its analysis on trucks as a simplifying assumption is discussed.

There follows a discussion of earlier freight-planning efforts and current freight-planning issues. Issues associated with the important truck mode are presented in three groups: 1) infrastructure investment, 2) urban policy, and 3) regional policy issues. Issues about other modes are also presented, often highlighting the intermodal connections between them and the truck mode.

After the freight issues are posed, a proposed freight action plan is presented. Work under the action plan falls into two broad groups. First, issues presented in the previous section serve as the basis for six specific freight studies. Second, data-intensive activities are discussed, notably: developing performance measurements, systematizing data collection, and improving the truck component of the regional model set.

The memorandum concludes by presenting several broader observations about the Boston Region MPO’s practices compared with those of other MPOs, which became apparent at the outset of this project as the capabilities of the Boston Region MPO were reviewed. These observations helped to both identify the issues and form the recommendations in the action plan.

The Massachusetts Freight Plan [page 3-51] obtained recent estimates of freight tonnage by mode. Statewide 2007 estimates of freight moved annually with either an origin or destination in Massachusetts were:

Truck: 195,950,000 tons

Rail: 14,630,000 tons

Water: 13,860,000 tons

Air: 310,000 tons

In addition to the freight tonnage that specifically serves Massachusetts (cited above), another 53,350,000 tons of freight pass through Massachusetts annually. Much of this originates in or is destined for upper New England along routes that mostly bypass the Boston Region MPO area. This through-tonnage is 81% truck only, 13% rail only, and 6% intermodal.

Freight projections were developed on a statewide basis by mode. Total freight movements in Massachusetts were projected to increase from 278 million tons in 2007 to 471 million tons in 2035, representing a compound annual growth rate of 1.9%. All modes are projected to grow, and trucks are projected to either maintain, or slightly increase mode share, depending on projection methodology. Accommodating an increase in freight tonnage of this general magnitude would pose a major challenge to regional infrastructure.

Comparable freight data is not available for the Boston Region MPO area. It is possible, however, to recognize several broad relationships between the statewide freight volumes and those within the 101 municipalities that comprise the Boston Region MPO.

The tonnage listed for rail includes both carload and intermodal service. In carload service, a rail car is delivered directly to a rail customer’s industrial tail siding, whereas in intermodal shipments, trailers and containers are loaded onto or removed from a train at an intermodal terminal and service to commercial customers for pickup, or delivery is made by truck.

The use of carload freight within the Boston Region MPO area has been in long-term decline. The industries for which carload freight is still competitive have gradually shifted their operations to larger facilities more distant from urban centers. Bulk commodities, chemicals, and building materials are representative of the types of freight that still are generating carload traffic.

Intermodal freight, however, is an increasingly viable mode for connecting urban areas to distant freight origins and destinations. Most of the rail freight entering the MPO consists of intermodal trailers and shipping containers that are transferred at either the recently expanded intermodal terminal in Worcester, or a terminal in Ayer. Neither of these two terminals is within the Boston Region MPO area, and their shipments originate and terminate throughout eastern Massachusetts and neighboring states. A meaningful portion of intermodal freight at these terminals serves the Boston Region MPO, however.

Similar patterns can be seen in the area of ocean shipping. All of the cargo of the container vessels serving Conley Terminal in South Boston—and most of the refined fuel arriving by ship in Chelsea, Everett, and East Boston—reach their final destinations by truck. These destinations may be within the Boston Region MPO, in a different Massachusetts MPO area, or in a neighboring state. Investigating these distribution patterns would significantly enhance understanding the role of ocean shipping in freight transportation.

There is still some ocean shipping in the Boston Region MPO area that does not utilize an intermodal transfer. Examples include jet fuel, which is piped from the terminal in East Boston to Logan Airport, and coal, which was delivered by ship directly to a power plant in Salem prior to its recent closing

Statewide, trucks accounted for 87% of the freight tonnage with an origin or destination in Massachusetts. A substantial portion of the remaining 13% of tonnage utilized a truck for a pickup or delivery. Within the Boston Region MPO area, the dependence upon trucks is even greater, given the very few remaining carload rail customers. The widespread use of intermodal transfers to move freight in the area does provide an opportunity to measure the flow of water- and rail-borne commodities in the region by studying the intermodal truck patterns in conjunction with any broader study of truck traffic.

The importance of freight in state and MPO transportation planning is acknowledged in federal statutes and regulations, but MPOs are afforded wide latitude in how they approach this mandate. At a minimum, MPOs must make a long-range projection of the movements of goods, as well as people, to inform their long-range transportation plans4. Furthermore, transportation plans must include “. . . strategies to improve the performance of existing transportation facilities to relieve vehicular congestion and maximize the safety and mobility of people and goods. . .”5

Given the wide latitude allowed to MPOs in their approach to freight analysis and planning, the practices of 77 American MPOs were reviewed, and a summary of the findings is included in Appendix A. These 77 MPOs vary greatly in population, land area, industrial and logistics activity, and institutional structure. If all of these factors are considered, there is no apparent “peer group” for the Boston Region MPO whose practices might be emulated. Appendix A does make a number of individual comparisons between Boston and other MPOs.

Most MPOs do not actually do freight planning in the sense of developing freight-specific plans that can be implemented. Those that do are often the implementing agency, or work in close consultation with the implementing agency.

If an MPO is not preparing freight-specific plans, it does not mean that freight is being ignored. Highway improvements developed by the MPO will help freight, which can be used as a factor in the planning process. The practice in the Boston Region MPO is to assign points to highway projects in the Transportation Improvement Plan (TIP) process based on an estimate of the importance of the project for freight. Also, some freight-specific projects in an MPO region may be planned and initiated by the state, some other implementing agency, or as part of a multi-MPO planning effort.

MPO highway travel models will normally have a truck component that can serve as a proxy for freight movements in the planning process. For most MPOs reviewed in the appendix, this represents the extent of their freight planning, with only a small minority of MPOs developing freight-specific transportation plans. Phoenix, Arizona, is an interesting example in that the MPO does not report undertaking any freight-specific planning; but it did report commissioning a truck survey whose results would be used for travel model improvement.

The Boston Region MPO has made consideration of freight an explicit goal in both its long- and short-range planning documents. Projects evaluated for inclusion in the TIP are scored partly according to the extent to which they improve freight mobility. The LRTP also discusses freight issues and potential investments such as harbor dredging that are not programmed through the MPO. Furthermore, it is now expected that studies focused on a particular area or corridor will have some commentary of freight or truck issues, even if these were not primary subjects of interest. Finally, the Boston Region MPO has begun exploratory work on developing transportation performance measurements that have been mandated by MAP-21; and one goal of this effort is that performance indices reflecting freight transportation as distinct from general traffic be defined in some manner.

In July 2012, a new multi-year federal transportation appropriation, Moving Ahead for Progress in the 21st Century, or MAP-21, was signed into law. Sections 1116-1118 of this act expressly concern freight-planning issues. Section 1118 strongly encourages states to develop comprehensive state freight plans. A practical incentive for states to develop these plans is found in Section 1116, which authorizes a higher share of federal funding for projects that can be shown to improve newly mandated freight performance measurements, providing that they are also included in the state freight plan. Finally, Section 1117 encourages states to form freight advisory committees.

MAP-21 does not prescribe a specific role for MPOs in developing freight plans. Interim Guidance on State Freight Plans and State Freight Advisory Committees6, mentions MPOs only twice. The State Freight Plan will need to discuss its decision-making process, including “ways in which the State coordinated with other States in regional planning efforts, and with metropolitan areas within the State that have done freight planning.”

The second reference to MPOs concerns membership in the State Freight Advisory Committee. Section 1117 of MAP-21 states that these advisory committees should include a cross section of public- and private-sector experts and stakeholders, which may include representatives of:

States had been encouraged in prior authorizations to develop state freight plans; and any states that had not yet developed a freight plan would be expected to. Those states, like Massachusetts, that had freight plans, were to build on these earlier efforts.

The Massachusetts Freight Plan (2010) was developed in consultation with input from a broad-based industry and advocacy working group. It is assumed that the primary focus of shipper and carrier advocacy would continue to be at the statewide level. Boston Region MPO staff has worked with freight stakeholders in the context of state-sponsored efforts, and will continue to be responsive to and reflect their concerns throughout the MPO freight program.

MAP-21 does establish an important new requirement for planning at all levels. States and MPOs are now required to develop, estimate, and periodically report performance measurements covering a range of transportation issues, including freight. This requirement to measure freight movement performance within an MPO is independent of whether an individual MPO has a distinct freight plan. The federal government is not exempt from this requirement. The individual state freight plans will inform a National Freight Strategic Plan for which performance measurements are also required. Another provision of MAP-21 reduces the local match of a federally funded project if the project is shown to be significant for freight and is included in the statewide freight plan.

The National Freight Strategic Plan performance measurements have not yet been defined, but when they do become defined, they will be offered as an acceptable formula for use by the states. In the interim, the U.S. DOT is encouraging states to develop performance measurements using their own analytical resources. A concern expressed by state officials is the scarcity of freight data that can be formed into some sort of performance index. Freight data is scarce at the state level and even more so at the MPO level. Identifying or acquiring data that can be crafted into a satisfactory MPO freight performance index is an important goal of the envisioned freight action plan.

One of the key findings of the Massachusetts Freight Plan was that 87% of freight shipments serving Massachusetts are truck only, and rail, ocean shipping and air freight combined make up only 13% of statewide tonnage. Furthermore, much of this 13% utilizes a truck for pickup or delivery.

Within the Boston Region MPO, truck distribution of intermodal rail, ocean shipping containers and refined fuels is even more important compared with the few carload rail and immediate dockside destinations. In addition, all air freight involves truck connections.

The prominence of trucks in regional logistics, both in truck-only and intermodal service, presents an opportunity for regional freight analysis. Developing a freight program focused on issues that affect travel in the MPO region, including a comprehensive picture of regional truck movements, would not only reflect the truck travel market, but also would reflect the important connecting intermodal markets.

Not only are trucks the dominant freight mode in eastern Massachusetts, but they represent a major portion of traffic on the regional road system. In recognition of this fact, the Boston Region MPO Phase I study focused on truck impacts. The final report, Results of the Boston Region MPO’s 2010 Freight Study – A Profile of Truck Impacts7, assembled most available regional truck data, but prominently offered a finding that truck data was inadequate and recommended a program of ongoing classification counts.

Other Phase I study findings include:

While trucks dominate regional freight transportation, either directly or in conjunction with an intermodal connection, a substantial number of trucks seen on regional roadways should not be thought of as freight shipments. Many trucks are engaged in local pickup and delivery activities that are not reflected in major freight surveys. A supermarket chain stocking its own stores falls into this category. Also, a significant portion of heavy vehicles are moving construction equipment, cement, building supplies, garbage, and the like. A program of study that focuses on trucks will comprehensively measure the burden of large vehicles on the MPO region’s roads, as well as reflect the great majority of freight shipments in the region.

The Massachusetts Freight Plan and the Phase I MPO study both recognized the vital role of trucks in the state and regional economies, and both studies identified the obsolete design of interchanges connecting major regional highways as an important issue for trucks. Congestion delay, high truck volumes, and high rollover risk associated with older interchanges affect both trucks and general traffic alike. Programming major highway improvements into the LRTP and associated planning documents is clearly an important responsibility of the Boston Region MPO.

A number of important truck issues, however, involve policy and regulatory matters. While the implementation of policies and regulations is the responsibility of various state and local authorities, the MPO and MPO staff have supported policy-related investigations. These efforts have usually been funded by MassDOT, or in one instance, Massport, but the work has been requested at various times by the MPO, member municipalities, or the state.

A recurring policy issue is the operation of trucks in dense urban areas. The CTPS report, Truck Traffic in East Cambridge and Somerville8 considered the definitions of “excessive truck traffic” and analyzed trucks in a study mandated by the 1997 state transportation bond bill. The Regional Truck Study9 was undertaken in close cooperation with an MPO technical subcommittee. This study focused primarily on Cambridge, Boston, and four adjoining municipalities, and analyzed the status of the roadway truck exclusions then in effect, and the legal prerogatives for establishing or modifying recommended, allowed, or prohibited truck routes.

In the course of these and other investigations MPO staff has become aware of a number of freight issues where the knowledge and capabilities of the MPO staff might be productively utilized, both for project planning as well as for policy analysis. MPO Staff seeks out opportunities to meet with carriers and state and local officials involved with freight issues. Valuable input to the MPO from the public at large is also received through the Regional Transportation Advisory Council, a member of the MPO.

The issues identified through analysis and outreach fall into three broad groups: infrastructure investment planning, urban policy issues, and regional policy issues.

The regional road system is shared by trucks and passenger traffic. Aging highway facilities built to the standards of an earlier era have a negative impact on both of these vehicle classes. The impacts on trucking can be especially serious:

These concerns are reflected by the Boston Region MPO in the preparation of the TIP. This involves reviewing crash data, available truck counts, and sometimes truck traffic assignments from the MPO travel model set. Based on these and other considerations such as land use, points are added to a project’s overall traffic benefit in recognition of potential benefits specifically for freight movement.

Interchanges of substandard design can cause congestion delay for all traffic, and safety hazards for both cars and trucks. However, certain aspects of obsolete interchange designs are especially serious issues for trucks. Many of these older interchanges have tight turns with a small turning radius, and are almost flat, lacking the recommended amount of superelevation, or banking of the roadway through the tight curves.

MassDOT and the Massachusetts State Police maintain highway crash records that are updated regularly and made available to MPO staff for mapping and analysis. Fortunately, truck crashes are unusual events and the sample size stays appropriately small, with incidents scattered about the region. The Phase I study utilized crash records extensively in developing its findings.

The crash experience record and knowledge of interchange design are complemented by learning the actual number of trucks using congested and obsolete interchanges in the regional highway system. Knowing actual truck volumes at these critical points is important for several reasons:

Unfortunately, very little reliable truck data is systematically collected, and what little that is available is for a limited number of points on interstate highways. Truck volumes at interchanges being considered for reconstruction and on surface roads are basically nonexistent. Obtaining classification counts that break down traffic by type of vehicle for regional roadways on an ongoing basis was one of the important recommendations of the Phase I study.

The impact of bridge weight and height restrictions poses an interesting analytical problem, since it is not possible to count trucks on facilities from which they are currently prohibited. The regional travel model set might be used to estimate how many trucks would use a bridge if it were rebuilt or an underpass if its clearance were increased.

Weight and height restrictions affect roadway facilities in a similar manner, but they reflect two distinct planning issues. In the case of weight restrictions, the bridge has lost its carrying capacity because of age and presumably will be rebuilt at some point. With height restrictions, the bridge may be in good condition, and increasing the clearance would entail decisions both to rebuild a serviceable structure as well as whether to allow trucks to use a route that had been unavailable.

Some of the most contentious and analytically challenging truck policy issues result from the need to deploy modern truck fleets in dense, older urban areas. The needs of urban populations reflect those of the population as a whole, but the street sizes and the numbers of persons exposed to noise and other adverse conditions differ markedly from the communities outside the urban core, which were laid out in more recent eras.

The need to provide truck access in dense urban areas is legally protected, and the operation of trucks here, as elsewhere, is subject to a variety of state and local regulations intended to ensure safety and minimize adverse effects. Some key issues that relate primarily to trucks operating in a dense urban environment include:

The issues of truck prohibitions and recommended routes, for both non-hazardous goods and hazardous cargoes, have proved especially difficult, both to analyze and to achieve policy consensus. Past efforts by MPO staff to evaluate route restrictions encountered the problem that complete listings of restrictions did not exist. Since these earlier route studies, the problem has become more complex as regional municipalities have interpreted the applicable regulations differently.

Without a master database of truck prohibitions, the best use of staff time might be to focus on a more limited area that could be thoroughly checked for signage. An MPO-sponsored effort could study routing and associated truck volumes in support of a MassDOT regulatory process.

Most truck prohibitions exist in urban areas and divert trucks to other routes within the same municipality. A recent effort, however, to change hazardous cargo routes had the potential to affect the radial interstate highways as far as, and including, the I-95/Route 128 circumferential corridor. Hazardous cargo routes are still classed here as an urban policy issue because the problem is greatest at locations with the highest population density and potential for exposure.

MPO staff supported MassDOT in the hazardous cargo route study. Travel times on alternative routes were measured or estimated, and exposure formulas for shopping malls calculated. Unfortunately, the numbers of fuel tankers that would be affected by the proposed routes were not known. Detailed data collection and model calibration that could have framed the policy issues more completely were not feasible within the study budget and timeframe.

Management of on-street truck loading and unloading appears on this list because it is a perennial community concern in urban neighborhoods, especially those with a strong small business presence. Ultimately, allocation of neighborhood curb space for loading or unloading is an issue for which the municipal authorities are responsible. MPO staff might, in collaboration with a municipality, study and evaluate an urban truck nexus. Analysis of on-street truck activities could also yield useful road network capacity data that could be applied to the MPO regional model set.

The motor carrier industry faces some important challenges in operating efficiently over longer, often statewide, routes. Industry representatives have highlighted two issues where MassDOT is in a position to offer policy leadership:

New, stricter federal regulations of hours of service by truck drivers will pose a major challenge to the long-distance trucking industry. There is strong sentiment in the industry that the number of rest areas on or near the express highway system in Massachusetts needs to be increased.

The siting of truck rest areas is likely to be a MassDOT policy issue rather than an MPO investment issue since it might involve securing support from a host municipality. Furthermore, current understanding of regional truck flows suggests that the optimal location for a truck rest area might actually be outside the Boston Region MPO area. MPO staff, however, would be able to use modeling, analytical, and field data gathering capabilities to support MassDOT in addressing the rest-area policy question.

The motor carrier industry has indicated to MPO staff that one of its high priorities is to obtain permission—accurately and expeditiously—for overweight and oversized loads to use state highways. These permits are issued on a shipment-by-shipment basis, many of which originate outside Massachusetts. Each permit recipient agrees to adhere to a prescribed route and employ the requisite auxiliary vehicles. Web-based delivery of the permit and required route is considered optimal. Geographic information system (GIS) capabilities of the Boston Region MPO might offer useful support for MassDOT efforts in this area.

Rail transportation is important in Massachusetts, and the state has taken the lead in rail planning, recently issuing the Massachusetts State Rail Plan10. State leadership in rail planning in the Boston Region MPO is assumed because the state owns the majority of rail rights-of-way in eastern Massachusetts, most of which are used primarily for passenger rail operations. Existing or prospective freight operations on these state-owned lines generally requires the cooperation of and often investment by the Commonwealth. Any MPO role in these types of policy decisions would most likely be confined to technical analysis by MPO staff.

Outside the MPO region, the state has partnered with the freight railroads to increase track clearances between New York State and the major intermodal terminals in Worcester and Ayer. Completion of these projects will allow trains hauling containers in a double-stacked configuration to reach these terminals, increasing capacity and reducing the operating costs of long-distance intermodal operations. While these terminals and associated improvements are outside the Boston Region MPO area, many containers are delivered to destinations in the Boston Region MPO, which will directly benefit from these improvements.

A new unit train freight service had recently been proposed to bring ethanol from the Midwest to a fuel terminal in East Boston. Currently, both ethanol and gasoline are delivered by water, blended at a fuel terminal, and then delivered by tanker trucks to regional gas stations. The proposed unit train would have consisted of a group of identical rail cars kept together and operated as a “unit” between a single origin-and-destination pair. The proposed unit train would have reduced or eliminated the need to receive ethanol by barge.

Unit trains of bulk commodities, notably coal, allow railroads to achieve the greatest economies of scale. Ethanol is a hazardous cargo, and prior to the withdrawal of the proposal by the proponent, MassDOT had initiated efforts to add a level of state-mandated emergency preparedness in addition to a federally administered safety review. While there was no direct MPO role in the associated track improvements or regulatory proceedings, an understanding of ethanol travel by rail can complement any work done by MPO staff on hazardous cargo truck routes.

The improvement or elimination of railroad grade crossings is also an important rail safety issue. These improvements are usually implemented as highway projects and are warranted by the frequency and speed of the region’s commuter rail service. Clearly, any rail freight operations in a corridor where grade crossings are eliminated will benefit, and grade crossing elimination should be considered a benefit to freight in any MPO project evaluation.

Rail access to the port of Boston is an often-cited freight issue. At this time, Massport has no plans to implement rail-on-dock service at its Conley Terminal in South Boston. While it is unlikely that the MPO would be involved in the investment decision, the MPO would be in a position to provide technical support, especially with regard to container flows.

The containers arriving at Conley are distributed by truck throughout New England, whereas transferring containers to rail would require developing a new, long-distance distribution market in competition with the large middle Atlantic ports. Massport is lengthening its wharf at Conley, and an expanding economy supported by added terminal capacity can be expected to result in a steady increase in truck traffic emanating from this terminal to serve Conley’s existing regional markets.

Another seaport access issue is the proposed extension of the so-called “Track 61,” also in the South Boston seaport. This track was last used to transport construction materials for use in the CA/T project, and was improved as far as a construction staging area, beyond which it has been inactive.

There have been proposals to reconstruct Track 61 to reach industrial parcels slated for new development, and it has always been assumed that service would be by the carload rather than large unit trains. While it is anticipated that rail rates for carload service would cover the rail service providers’ operating costs, very little contribution to the capital costs of reconstruction would be anticipated, and it is assumed that reconstructing Track 61 would be a public investment, justified to a large degree by support of the working port. The MPO might at some point be involved in programming a public investment, and MPO staff would be able to analyze freight travel impacts.

Massport is considering whether to deepen the channel approaching the Conley Terminal to accommodate larger, so-called “post-panamax” vessels that would begin passing through new, larger Panama Canal locks in 2015. This would be a major investment on the part of Massport, even with a substantial federal contribution, itself contingent upon appropriation. The container ships that serve Conley Terminal usually off -load only a portion of their containers. Accommodating larger vessels would not necessarily increase container shipments into Boston. Conversely, if post-panamax ships cannot serve Conley Terminal, the portion of the world’s container ships that could serve Boston would gradually decline as more of these larger vessels are built.

Air freight has historically experienced stronger growth than the other modes, and all air freight depends upon trucks to connect with customers. Logan Airport has a very small land area for an airport with its level of activity, land that must be shared by passenger, freight, and airline support facilities. Long-term growth in air freight may eventually necessitate adding or expanding regional air freight facilities. Given the scarcity of land at Logan Airport, it might be feasible to direct some future air-side growth to locations like the Massport-operated Worcester airport or the former Pease Air Force Base in New Hampshire.

Several authorized-vehicle-only roadways have been constructed to support both ocean container and air freight movements, and counting trucks on these special-purpose roadways can yield valuable freight data that can also be used to evaluate special-purpose roads as a freight strategy. If opening these routes to general traffic is studied and found feasible, this could become an element of an MPO congestion management strategy.

The goals of the MPO freight action plan stated at the outset of this memorandum are:

Related to these broad goals are a number of freight-specific issues concerning the important truck mode as well as the other freight modes. These issues concern establishing infrastructure investment priorities as well as regulatory issues for which state and local authorities are ultimately responsible.

This freight action plan envisions efforts in two broad areas:

The current freight issues that have been included in the action plan are those which MPO staff believes would elicit general stakeholder support. Issues such as local truck prohibitions, on-street loading/unloading, overweight/oversize load routing and permitting, and non-highway investments are issues that MPO staff could study in the future. These studies would require close consultation with implementing agencies as well as stakeholder consensus.

MPO and state planning efforts have identified two key highway interchanges—notably the I-93/I-95 interchanges located in Woburn north of Boston and Canton south of Boston, respectively—as causes of severe regional congestion. In addition, crash data and deficient highway geometry at these interchanges indicate that safety is an issue for trucks. To supplement ongoing review of crash data and deficient interchange design, truck volumes estimates should be obtained, either from the regional model set, field observation, or both, in order to:

- complete the safety analysis, and

- support a potential application for 95% federal funding, in accordance to MAP-21 provisions.

The need to reconstruct the badly deteriorated Beacham Street, serving industrial areas in Everett and Chelsea, has been apparent for a long time. This project, however, is not included in any of the current MPO planning documents. The importance of this corridor for regional logistics is broadly acknowledged, and the freight action plan could anticipate the inclusion of this corridor in an MPO or state plan at some point. This effort would identify major trip generators, notably produce terminals, fuel depots, a scrap metal export pier, and a postal service processing center. Truck movements at these locations would be counted and some proximate turning movements observed. The result would be a clear picture of how freight flows between this industrial area and the regional road network.

As a subject of study, Beacham Street has everything: truck depots, fuel depots, truck trips originating, truck trips passing through, aging roadways, and potentially a nearby casino. A completed Beacham Street study can serve as a model for studies at comparable locations throughout the MPO. Also, one or more points within the study area may be suitable for ongoing measurement as part of the new performance measurements required by MAP-21.

Urban hazardous cargo movements continue to be of state and local policy interest, and the distribution of fuel from the terminals in East Boston, Chelsea, Revere, and Everett should be a high priority. This work would be similar to the Beacham Street analysis, except that it would include some more distant fuel depots in Revere, East Boston, and other parts of Chelsea. The density of fuel trucks in traffic thins the further the trucks are from their terminals of origin, but some attempt should be made to analyze fuel truck flows to where they enter downtown Boston.

The designation of hazardous cargo routes is an ongoing policy issue within the geographical extent of the MPO. Although the policy deliberations are outside the MPO process, some of the parties involved in the policy issues are MPO members. In this regard, developing data about hazardous cargo movements can be viewed as supporting the MPO.

Some roadways in Boston are limited to commercial vehicles, both trucks and buses. The operating authorities for these routes, MassDOT and Massport, have the option of changing the use eligibility for these facilities. Indeed, general use of the South Boston Haul Road is planned during the upcoming Callahan Tunnel closure. Topics of this study may include:

- Callahan Tunnel closure before/after analysis

- Volumes of seaport- or airport-related truck traffic

- Viability of truck-only routes as a freight strategy

- Feasibility and potential benefits of opening these routes to all vehicles. Appropriateness of using these routes as part of congestion mitigation strategy can be considered.

The capacities of Conley Terminal, Logan Airport airfreight operations, and the intermodal freight terminals in Worcester and Ayer may well be expanded in the future without a need to be programmed by the Boston Region or any other Massachusetts MPO. The resulting increases in intermodal trucking, however, will definitely have an impact on the MPO region, and MPO members have in the past and can be expected in the future to have concerns about intermodal terminal operations. MPO staff can measure use of these terminals using techniques similar to the Beacham Street and hazardous cargo studies, and estimate an existing-conditions baseline that can inform analysis of long-term trends or proposed investments.

This is an important truck corridor connecting the Middle Atlantic and Upper New England regions. This route is at the edge of the Boston Region MPO but entirely within the Boston Region MPO travel demand model area. This has been suggested as a promising area where a needed new truck rest stop might be sited, either on or off I-495. Data from truck counts, license plate surveys, or postcard surveys could be used in conjunction with the statewide model to help state and local authorities estimate the potential use and benefit of any planned rest area, as well as inform traffic safety and operational analyses.

The new transportation performance measures mandated by MAP-21 are now in the second year of a three-year federal rulemaking process, which is expected to go into effect in spring 2015. The 2012 MAP-21 authorization was unusual in that it is only in effect for two years, several years less than other recent multi-year authorizations. It is possible that a new authorization would be enacted in 2014, and would take effect prior to completion of the performance measures rulemaking process. In theory, Congress could modify or even eliminate this reporting requirement. The working assumption at this point is that the rulemaking process would not be affected by the re-authorization.

Up to this time, truck crash data has been a basic tool to indicate parts of the road system that are not serving freight movements safely. State transportation planners assume, however, that measuring the performance of the freight transportation system and tracking its progress will require significantly more data about the patterns and timeliness of truck movements within regional traffic.

Regional traffic congestion is an ongoing concern, and is studied as part of federally mandated Congestion Management Process (CMP). It is assumed that ultimately these ongoing CMP efforts will inform the MPO performance measurement requirements for regional traffic. As in the case with truck crashes, to truly understand the impact of regional congestion on truck traffic, it is necessary to estimate the truck portion of traffic during the most congested periods.

It is anticipated that the regulations that are promulgated in 2015 will set overall measurement requirements, but will also offer a measurement approach that affected jurisdictions can choose to utilize. Until that time, states and MPOs are encouraged to innovate and develop indices from available data. The Boston Region MPO might develop a freight performance measurement utilizing CMP and crash data, as well as data derived from the Boston Region MPO and statewide model sets.

The freight-specific investigations described in the previous section are assumed to be funded as part of the envisioned ongoing MPO freight program. The MPO or MPO members might suggest additional freight-specific studies that the ongoing program would undertake, when practical. As has been done at times in the past, the MPO could allocate funds for a freight-specific study that would have its own scope and schedule.

Most studies undertaken at the direction of the MPO are not freight specific, however. These studies variously look at corridors, intersections, station areas, or regional congestion. Trucks in varying numbers make up a portion, usually unknown, of traffic in the diverse study areas. Estimating the impact of trucks, as well as the benefits to trucks of improvements within the study area, is difficult when the truck volumes are not known. In many cases, calculating the impacts and benefits of total traffic is a perfectly acceptable approximation.

Coordination between these more general studies and the freight action plan can provide an efficient way of obtaining truck data on an ongoing basis. Many regional locations are studied each year, some of which involve more freight and logistics activities than others. Those locations with more noteworthy freight activities can be studied as resources permit as part of the freight action plan. These efforts would yield freight analyses for incorporation into the general studies, and data obtained would be structured for use in ongoing model improvement efforts. Efficiencies would be derived in this approach as analysts looking at different aspects of a study—such as land use, traffic, and safety—would be able to coordinate their efforts and pool their findings.

A recent example of potential synergy was presented by a study of safe bicycle and pedestrian access to an urban transit station. A field visit noted relevant safety issues, and also observed that the station was next to a large plumbing-supply distributer. It was noted that the plumbing distributer did not appear to pose any dangers to station access. However, several hours of additional field work could have established a ratio of large trucks supplying the distributor to smaller plumbers’ vans purchasing supplies. Patterns of access and egress and trip-generation rates might also have been noted. Such additional findings might have been appropriate at some level of detail for the station area analysis, but would have extremely valuable in truck model development.

The freight-specific studies as well as the freight enhancements of the more general studies are all assumed to require new data collection. Neither existing truck data nor current model assignments adequately represent truck activity at most regional locations.

Given the general scarcity of detailed freight and truck data, the quantity of data that the action plan might develop in the studies listed above represents a veritable trove of new knowledge about regional logistics. Not only would these newly obtained data inform discussion of regional transportation issues, but they also would provide vital raw material for the process of improving truck components of the regional travel demand model set.

Appendix B describes in greater detail the treatment of trucks in the travel demand model and the techniques that can be used to improve the modeling of truck movements. The appendix lists three important capabilities offered by a calibrated model:

In addition to these three practical uses might be added a fourth use. The model can serve as a repository for the diverse types of truck data acquired to address the issues and topics of concern to stakeholders. Re-estimation of truck components of the travel demand model as data is acquired allows the model to gradually evolve into a more dependable representation of truck activity.

The performance measurements that are mandated by MAP-21 are still being developed. The freight measurements will be promulgated later in the process, with review of proposed rules in 2014 and final rulemaking in 2015.

It is anticipated, however, that there will be some flexibility within the regulations that are eventually adopted. The acquisition of data and its incorporation into a process of model improvement will prepare the Boston Region MPO to respond to guidance from the future federal regulations.

Development of the freight planning action plan began with a review of MPO freight planning practices, both in Massachusetts and elsewhere, with special attention to the vital state roles in freight planning. The freight planning capabilities of the Boston Region MPO were also reviewed. Several general observations from the exploratory phase of this study that informed the preparation of the action plan include:

Federal legislation and regulations allow MPOs great latitude in defining their freight planning responsibilities. This is not the case for states, which are now expected to develop freight plans. Both MPOs and state DOTs are now required by MAP-21 legislation to define and estimate transportation performance measurements, including those for freight.

A review of 77 MPOs including Boston, described in Appendix A, shows a broad range of MPO freight planning activities. There is no obvious peer group whose practices the Boston Region MPO might seek to emulate. Those MPOs that develop freight-specific plans do so in close cooperation with the implementing agencies. MPOs that do not report developing freight-specific plans still reflect trucks in the travel demand models supporting the MPO planning process.

A common practice is for freight planning to be undertaken primarily on a statewide or multi-MPO basis, with MPOs in these focusing on other transportation and land-use issues. The widespread practice of statewide and multi-MPO freight planning acknowledges that the relevant geography for logistics is more extensive for freight than for passenger transportation. While statewide and multi-MPO planning efforts can be designed to include important regional terminals and distribution centers, issues such as mode shifts between freight modes can only be addressed on a multi-state, national, or North American basis.

Trucks are the dominant mode for freight in eastern Massachusetts and a major component of regional traffic. Most freight arriving in eastern Massachusetts by rail, ship, or air is trucked from a select number of known intermodal transfer terminals. A thorough understanding of truck movements, including the intermodal connections, can provide a complete picture of regional logistics.

The lack of freight data at the regional level is well documented in this and other MPO regions in the U.S. As explained earlier, this data is important for analyzing specific freight-related issues. To this end, data have to be collected in the field or gathered from existing sources. The collected or gathered data would also be used to calculate values for the selected freight performance measures, as required in MAP-21.

In addition to collecting and gathering data, specifically truck volumes, staff could synthesize existing truck flows through model applications in order to estimate truck traffic in other segments of the roadway network. The Boston Region MPO is in a position to use its considerable technical capabilities in both modeling and analysis to support regional and statewide freight planning needs. The Boston Region MPO travel model set includes a network covering 164 eastern Massachusetts municipalities, a span that includes four entire MPOs and parts of three adjoining MPOs. MPO staff is also able to utilize the statewide model as necessary to analyze logistics centers outside the Boston MPO region model area that influence freight movements within the regional model area.

The specific tasks included in the recommended action plan fall into two general groups: 1) studying specific freight-related issues, and 2) expanding and utilizing MPO data and technical resources. Each task in these two groups furthers one or more of the five action plan goals:

The first three goals are met through six recommended studies. These six studies could be supplemented by similar studies requested by the MPO membership. The six initial studies are:

Most of these six studies also complement official planning efforts insofar as some level of official planning interest has been expressed about the topics. These studies also focus on locations and topics where a large amount of truck and logistics data would be obtained in the course of the study, supporting the fourth goal of expanding technical capabilities.

There are three action items that meet the last two goals above:

The figure on the following page shows graphically the development of the Proposed MPO Freight Action Plan.

In closing, the proposed MPO Freight Planning Action Plan described in this memorandum will yield important policy findings, logistics insights, and useful data. These efforts will also form an MPO freight planning foundation on which to base further freight study and analysis.

WSK/wsk

The requirements of the MPO planning process are described in the Code of Federal Regulations (CFR), Part 450. There are several references to freight in CFR § 450.322, which concerns the development and content of a metropolitan transportation plan. The prescriptive text is:

This implies that MPO freight planning might focus on trucks that can be projected and studied as a component of overall road traffic. In this minimal sense, traffic planning is freight planning.

Other freight modes can also be studied, either by MPOs or as part of required statewide freight plans. The analysis and modeling of truck movements by MPOs, however, remains a core planning capability for four reasons:

In addition to the basic requirement that MPO planning “…relieve[s] vehicular congestion and maximize[s] the safety and mobility of people and goods,” MPOs may choose to become involved in freight planning. Better understanding the variety of MPO freight planning practices is the purpose of this appendix.

A large sample of MPOs was selected for this analysis in order to ensure that a variety of freight planning efforts would be represented. An initial 70-MPO sample was formed consisting of Boston as well as all 69 MPOs that are geographically larger than the Boston region. In addition, seven selected MPOs geographically smaller than Boston are discussed later in this memorandum.

After the large MPOs were identified, an initial group of websites was studied to learn the types of freight-specific activities being reported, focusing especially on publications. This preliminary review suggested that MPO freight-specific activities could be thought of as a set of ascending steps. The 70 large and 7 small MPOs were then characterized by the highest level of freight planning activity that they report.

At the lowest level, an MPO website will report no freight-specific activities at all. Travel demand models utilized by these MPOs may have a truck component, but this is not considered a “freight-specific activity.”

The next level up is the case of an MPO that does no freight-specific planning itself, but participates in a larger regional group, usually consisting of several MPOs, that has some level of freight-specific activity.

The minimal MPO freight-specific activity is sponsoring a freight advisory group. Membership structures vary, and limits on the scope of proffered advice appear few.

The next step is doing freight-specific studies. At this level, the studies tend to give an overview of freight in the MPO region, offer broad recommendations, and allow decision makers and implementing agencies to be better informed about freight issues. These studies may be performed by MPO staff or by a consultant working for the MPO.

The highest level of freight planning is for an MPO to develop specific infrastructure proposals, or analyze and select freight-specific projects. The planning efforts may be performed by MPO staff or by a consultant working for the MPO. A resulting freight-specific proposal can be implemented by an operating agency.

A website maintained by the U.S. DOT lists all MPOs and their websites, as well as both population and land area of each planning region. The readily available land area measurement not only serves as a basis for selecting the 70-MPO sample, but provides a context for considering the role of MPOs in freight planning. Industrial and logistics activities that benefit from economies of scale are now finding suitable sites further from urban centers at locations that are more likely to be within a geographically large MPO.

Table 1 summarizes the freight-planning efforts of the 70 geographically largest MPOs, including Boston. In the table, MPOs are grouped by their highest level of freight-specific activity. MPOs doing “planning,” the highest level, are listed at the beginning of the table and are referred to as the planning group. After the planning group are 7 MPOs that do studies, the study group, followed by two groups of MPOs progressively less involved with freight. The 32 MPOs that report no freight-specific activity comprise the remainder of the table.

Boston appears on the first page in boldface type and is characterized as an MPO that studies freight issues. To facilitate comparison of the Boston Region MPO with other MPOs, the population and land area columns in Table 1 are expressed as an index, with Boston equaling 100 for both metrics.

With 3,160,000 residents, the Boston Region MPO is the 14th largest MPO by population. With 1,458 square miles, however, Boston is only the 70th largest MPO geographically. The 69 other MPOs cited in Table 1 all have land area indices greater than 100. In the case of the Los Angeles MPO, the land area is more than 26 times greater.

Each MPO group is arranged in descending order of population. No MPO more populous than Boston has a smaller land area, and all 13 MPOs with more residents appear in Table 1. Of the 14 MPOs in the planning group, seven are more populous than Boston. In the study group, North New Jersey, Houston/Galveston, and Detroit have more residents than Boston. On the second page of Table 1 are shown the six MPOs that only sponsor advisory groups, and of these only Seattle/Tacoma is more populous than Boston. Washington, DC and Phoenix, AZ are more populous than Boston, but lead the group of 32 MPOs that report no freight-specific activity at all.

The population densities of each MPO are also shown in Table 1. With 2,167 residents per square mile, Boston is the second-densest MPO region. The MPO for New York City is the densest MPO, extending nearly twice the land area as Boston but having almost four times the population. The third densest MPO is Chicago, but its density is achieved with population and land area almost three times those of Boston.

| Location | State(s) | Boston=100 Population |

Boston=100 Area |

Population/ Square Miles |

Freight-specific MPO activities featured on website Advise |

Freight-specific MPO activities featured on website Study |

Freight-specific MPO activities featured on website Plan |

Other freight-related activities | Total Population |

Square Miles |

|---|---|---|---|---|---|---|---|---|---|---|

| LA area (6 counties) | CA | 571 | 2,651 | 467 | x | x | x | MPO freight subcommittee | 18,051,203 | 38,649 |

| NYC (10 counties) | NY | 391 | 187 | 4,537 | N/A | x | x | N/A | 12,367,508 | 2,726 |

| Chicago | IL | 267 | 281 | 2,062 | x | x | x | C.R.E.A.T.E. participant | 8,444,660 | 4,096 |

| SF area (9 counties) | CA | 226 | 513 | 955 | N/A | x | x | Trade Corridor Improvement Fund | 7,150,828 | 7,485 |

| Dallas/Fort Worth | TX | 203 | 341 | 1,292 | x | x | x | dedicated 4-person freight staff | 6,417,630 | 4,969 |

| Philadelphia | PA, NJ | 178 | 261 | 1,476 | x | x | x | N/A | 5,626,318 | 3,811 |

| Atlanta | GA | 153 | 314 | 1,054 | x | x | x | N/A | 4,819,026 | 4,573 |

| San Diego County | CA | 98 | 292 | 727 | N/A | x | x | TransNet county tax measure | 3,095,271 | 4,260 |

| Pittsburgh | PA | 81 | 488 | 362 | x | x | x | N/A | 2,574,953 | 7,110 |

| Cincinnati | OH,KY,IN | 63 | 180 | 756 | x | x | x | N/A | 1,981,230 | 2,619 |

| Hampton Roads | VA | 51 | 143 | 777 | x | x | x | N/A | 1,618,505 | 2,082 |

| Nashville | TN | 44 | 199 | 477 | x | x | x | N/A | 1,382,526 | 2,899 |

| Buffalo | NY | 36 | 108 | 721 | N/A | x | x | N/A | 1,135,511 | 1,576 |

| Fresno County | CA | 29 | 413 | 155 | x | x | x | San Joaquin Valley Blueprint (8 MPOs) | 930,885 | 6,016 |

| 14 MPOs Combined | N/A | 171 | 455 | 814 | N/A | N/A | N/A | N/A | 5,399,718 | 6,634 |

| Location | State(s) | Boston=100 Population |

Boston=100 Area |

Population/ Square Miles |

Freight-specific MPO activities featured on website Advise |

Freight-specific MPO activities featured on website Study |

Freight-specific MPO activities featured on website Plan |

Other freight-related activities | Total Population |

Square Miles |

|---|---|---|---|---|---|---|---|---|---|---|

| North Jersey | NJ | 208 | 302 | 1,492 | x | x | N/A | N/A | 6,579,801 | 4,409 |

| Houston/Galveston | TX | 186 | 581 | 696 | N/A | x | N/A | N/A | 5,892,002 | 8,466 |

| Detroit | MI | 149 | 316 | 1,021 | N/A | x | N/A | C. of C. Translinked participant | 4,703,593 | 4,608 |

| Boston | MA | 100 | 100 | 2,167 | x | x | N/A | N/A | 3,159,512 | 1,458 |

| Cleveland | OH | 66 | 138 | 1,033 | N/A | x | N/A | N/A | 2,071,325 | 2,006 |

| Austin | TX | 51 | 195 | 565 | N/A | x | N/A | N/A | 1,603,952 | 2,840 |

| Birmingham | AL | 27 | 133 | 441 | x | x | N/A | N/A | 853,551 | 1,934 |

| Yuma | AZ, CA | 6 | 379 | 35 | N/A | x | N/A | N/A | 195,807 | 5,522 |

| 8 MPOs Combined | N/A | 99 | 268 | 802 | N/A | N/A | N/A | N/A | 3,132,443 | 3,905 |

| Location | State(s) | Boston=100 Population |

Boston=100 Area |

Population/ Square Miles |

Other freight-related activities | Total Population |

Square Miles |

|---|---|---|---|---|---|---|---|

| Seattle/Tacoma | WA | 117 | 438 | 578 | FAST Corridor participant | 3,690,866 | 6,384 |

| Baltimore | MD | 84 | 158 | 1,158 | N/A | 2,662,204 | 2,299 |

| Miami | FL | 79 | 138 | 1,237 | N/A | 2,492,108 | 2,015 |

| Sacramento | CA | 72 | 424 | 368 | N/A | 2,274,557 | 6,189 |

| Kansas City | MO, KS | 60 | 149 | 875 | Kansas City Smartport member | 1,895,535 | 2,167 |

| Albany | NY | 26 | 151 | 374 | N/A | 823,239 | 2,204 |

| 6 MPOs Combined | N/A | 73 | 243 | 651 | N/A | 2,306,418 | 3,543 |

| Location | State(s) | Boston=100 Population |

Boston=100 Area |

Population/ Square Miles |

Other freight-related activities | Total Population |

Square Miles |

|---|---|---|---|---|---|---|---|

| Bakersfield | CA | 27 | 560 | 103 | San Joaquin Valley Blueprint (8 MPOs) | 839,614 | 8,161 |

| Monterey (3 counties) | CA | 23 | 353 | 142 | Central Coast Comm. Flows (3 MPOs) | 732,667 | 5,151 |

| Harrisburg | PA | 18 | 117 | 337 | 5-MPO South Central PA Freight Study | 571,847 | 1,699 |

| Stanislaus County | CA | 16 | 104 | 340 | San Joaquin Valley Blueprint (8 MPOs) | 514,453 | 1,514 |

| Spokane | WA | 15 | 122 | 265 | Inland Pacific Hub participant | 471,221 | 1,776 |

| Tulare County | CA | 14 | 332 | 91 | San Joaquin Valley Blueprint (8 MPOs) | 442,171 | 4,838 |

| Santa Barbara County | CA | 13 | 189 | 154 | Central Coast Comm. Flows (3 MPOs) | 423,891 | 2,751 |

| San Luis Obispo County | CA | 9 | 228 | 81 | Central Coast Comm. Flows (3 MPOs) | 269,637 | 3,323 |

| Merced County | CA | 8 | 135 | 130 | San Joaquin Valley Blueprint (8 MPOs) | 255,366 | 1,971 |

| Madera County | CA | 5 | 148 | 70 | San Joaquin Valley Blueprint (8 MPOs) | 150,865 | 2,152 |

| 10 MPOs Combined | N/A | 15 | 229 | 140 | N/A | 467,173 | 3,334 |

| Location | State(s) | Boston=100 Population |

Boston=100 Area |

Population/ Square Miles |

Total Population |

Square Miles |

|---|---|---|---|---|---|---|

| Washington | DC,MD,VA | 158 | 213 | 1,604 | 4,991,324 | 3,111 |

| Phoenix | AZ | 123 | 640 | 415 | 3,871,710 | 9,338 |

| Minneapolis/St. Paul | MN | 90 | 204 | 959 | 2,849,557 | 2,970 |

| Denver | CO | 89 | 247 | 784 | 2,827,082 | 3,605 |

| St. Louis | MO, IL | 81 | 315 | 561 | 2,571,253 | 4,586 |

| Milwaukee | WI | 64 | 184 | 752 | 2,019,767 | 2,685 |

| Las Vegas | NV | 62 | 555 | 241 | 1,951,300 | 8,089 |

| Orlando | FL | 58 | 196 | 642 | 1,837,385 | 2,860 |

| Salt Lake City | UT | 49 | 122 | 879 | 1,561,348 | 1,777 |

| West Palm Beach | FL | 42 | 137 | 659 | 1,318,571 | 2,002 |

| Jacksonville | FL | 40 | 127 | 687 | 1,274,426 | 1,855 |

| Oklahoma City | OK | 36 | 144 | 545 | 1,140,532 | 2,093 |

| Raleigh | NC | 34 | 110 | 669 | 1,071,012 | 1,600 |

| Tucson | AZ | 31 | 631 | 107 | 980,263 | 9,195 |

| Richmond | VA | 30 | 148 | 431 | 934,060 | 2,165 |

| Northwest Indiana | IN | 24 | 104 | 507 | 771,648 | 1,523 |

| Little Rock | AR | 20 | 110 | 388 | 621,397 | 1,603 |

| Polk County | FL | 19 | 138 | 299 | 602,069 | 2,013 |

| South Jersey | NJ | 19 | 119 | 342 | 594,419 | 1,738 |

| Lansing | MI | 15 | 117 | 271 | 464,036 | 1,712 |

| Central Mississippi | MS | 15 | 109 | 289 | 461,430 | 1,595 |

| Northwest Arkansas | AR | 13 | 126 | 231 | 424,404 | 1,836 |

| Reno | NV | 13 | 445 | 64 | 412,326 | 6,489 |

| Beaumont | TX | 12 | 153 | 174 | 388,746 | 2,229 |

| Shreveport | LA | 12 | 124 | 206 | 371,948 | 1,805 |

| Marion County | FL | 10 | 114 | 199 | 331,309 | 1,665 |

| Naples | FL | 10 | 145 | 152 | 321,522 | 2,117 |

| Utica | NY | 9 | 186 | 111 | 299,541 | 2,710 |

| Butte County | CA | 7 | 115 | 131 | 220,000 | 1,675 |

| Shasta County | CA | 6 | 264 | 46 | 177,223 | 3,843 |

| Glens Falls | NY | 5 | 125 | 79 | 143,664 | 1,818 |

| Skagit County | WA | 4 | 120 | 67 | 116,901 | 1,750 |

| 32 MPOs Combined | 38 | 206 | 395 | 1,185,068 | 3,002 |

Three columns in the center of the first page of Table 1 indicate MPO efforts in each of the three freight-specific activities: advising, studying, and planning. While Boston sponsors a freight-advisory group, a number of MPOs that do studies or develop plans do not report having a freight advisory committee. In these MPOs, any freight advocacy takes place outside the MPO, and some websites make reference to these non-MPO efforts, such as the Translinked advocacy effort sponsored by the Detroit Chamber of Commerce, shown directly above Boston. Six MPOs that only sponsor freight-advisory committees are listed in their own group at the top of the second page of Table 1.

The importance of geographical extent in freight planning is illustrated by the two MPO groups on the second page of Table 1: MPOs that only sponsor freight-advisory groups and efforts by larger, regional groups. The Seattle/Tacoma MPO is more populous than Boston and covers more than four times the land area, but its freight plans are developed through the Freight Action Strategy for the Everett-Seattle-Tacoma Corridor (FAST Corridor) effort that includes neighboring MPOs, state agencies, and private carriers. The freight planning for Kansas City is also undertaken by a larger, multi-jurisdictional group that includes the MPO as a member.

Geographical extent is also expanded by developing freight plans on a multi-MPO basis. Sixteen MPOs are referenced in Table 1 as participating in multi-MPO freight planning. All MPOs in California consist of one or more counties, and eight single-county MPOs cooperate in a planning effort called the San Joaquin Valley Blueprint. Seven of these eight MPOs are larger than the Boston Region MPO and appear in Table 1. All eight websites cite ongoing freight-planning efforts undertaken under the aegis of the Blueprint. Fresno County, a Blueprint member, also does its own freight planning and is included in the planning group of MPOs.

Three California MPOs consisting of five counties extending from Monterey Bay to Santa Barbara have joined to sponsor the Central Coast Commercial Flows Study. This study identifies freight bottlenecks and is also working with the Monterey Bay MPO to evaluate the potential for a rail intermodal terminal specializing in agricultural products.

Five MPOs in Pennsylvania jointly commissioned the South Central Pennsylvania Freight Study. Only the Harrisburg MPO is larger than Boston, and it mentions no freight-specific activity outside of the five-MPO study.

The freight-specific planning activities by the14 MPOs in the planning group at the beginning of Table 1 are interesting in two respects. Not only do they illustrate a range of MPO planning activities, but they also manifest institutional arrangements where the MPO is entrusted with freight-planning responsibilities. Many of the planning studies are done by consultants, but the detail and specificity of the proposals accepted by the MPO clients indicates the central role of these MPOs in certain aspects of the freight-planning process. This section highlights only a few of the freight-planning topics investigated by these MPOs.

The importance of freight planning in Los Angeles region is emphasized by the appointment of a board-level freight subcommittee by the MPO. Along with broader regional studies, the MPO takes a lead in port access planning. It sponsored a major study on the development of so-called inland ports that utilize rail shuttles to reduce seaport roadway congestion. Econometric estimates of the elasticity of container lift fees support port operators in determining appropriate fees that might be charged to support port access infrastructure.

The New York City MPO includes two counties on Long Island. Getting freight onto and off of Long Island is a long-standing and worsening regional bottleneck, and the MPO has studied a number of approaches for improving freight access to Long Island. Warehousing and accommodating the quantities of urban delivery trucks also receives planning attention.

The headline effort of Chicago-area planning is the Chicago Region Environmental and Transportation Efficiency Program, known as CREATE. CREATE involves federal, state, MPO, and municipal planners, as well as eight private railroads, and has developed a far-reaching investment plan that will improve freight and passenger rail service both serving and traversing Chicago. The Chicago MPO participates in CREATE, but also studies highway truck bottlenecks and recommends truck and other freight improvements.

In 2006, California voters approved Proposition 1B. This measure created the Trade Corridor Improvement Fund (TCIF) with $2.5 billion in bonding authority that could be used to leverage local and private funds to support investment in a high-priority goods movement infrastructure. The San Francisco-Oakland Bay Area MPO was charged with developing the TCIF investment plan, and in the process, also studied land use trends.

This MPO has a dedicated four-person staff devoted to freight issues. In addition to doing mapping and regional freight studies and supporting an advisory group, MPO staff is responsible for developing recommendations for truck lane restrictions on regional express highways, and ongoing planning for road/rail grade crossing elimination.

The MPO for Philadelphia is a bi-state MPO, including Camden, New Jersey and environs. Its long-range freight plans include numerous specific proposals regarding highways, railroads, and warehousing. The port authority sits on the MPO governing board, but the MPO does not do port planning.

The Atlanta MPO commissioned a comprehensive, multi-modal study, the Atlanta Region Freight Mobility Plan. A key finding was the lack of a coherent set of truck routes. This resulted in a follow-on study, the Atlanta Strategic Truck Route Master Plan.

MPO staff has identified numerous freight-specific transportation investments for San Diego. The MPO also commissioned a feasibility study on reopening the San Diego, Arizona and Eastern rail corridor between San Diego and Yuma, Arizona. Rail and highway border crossings to Mexico are an important planning consideration. California allows countywide referenda on adding 5% to the sales tax within a county for transportation investments. The Transnet Tax measure was first enacted in 1988, and will be in effect through 2044.

The Pittsburgh MPO works closely with the Pennsylvania Bureau of Rail Freight and the U.S. Corps of Engineers on rail and river navigation issues. The MPO directly plans road projects that emphasize the needs of freight. The MPO promotes advocacy through conferences and working groups.

The regional freight plan of this tri-state MPO recommends 58 projects that support trucks, rail freight, river navigation, and air cargo.

Every several years, MPO staff prepares a comprehensive freight study titled Intermodal Management System Regional Freight Study. This study begins with an exhaustive review and update of regional and port freight statistics, and concludes with a small set of very specific freight-specific investment recommendations.

Nashville is a rail and air cargo hub, and has substantial waterborne freight on the Cumberland River. The MPO studies all modes, and develops specific recommendations to better accommodate trucks on regional roadways, including improvements to truck rest areas.

This is the only MPO in the planning group close to the Boston MPO in geographical size. The recently completed freight transportation study focused to a major extent on the challenge of economic development. Road and rail capacity was found to be generally adequate, and rail recommendations were a restatement of the New York State Rail Plan. Roll-on/Roll-off Great Lakes truck transportation was not deemed viable. The MPO region might be a good location for prospective logistics centers.

Fresno County is less than a third the population of the Boston MPO, but is four times the land area. In addition to the eight-MPO San Joaquin Blueprint freight planning process, Fresno COG also sponsored a study on how best to realign the various freight rail lines serving and passing through Fresno in anticipation of the introduction of high-speed rail service.

Of the 70 MPOs in Table 1, 32 do not report any freight-specific activity, and are cited on the last two pages of Table 1. The Washington, DC and Phoenix, Arizona MPOs are more populous than the Boston Region MPO, and Minneapolis and Denver are similar in population. Most of the geographically smaller MPOs, some only slightly larger than Boston, are found in this group.

The Phoenix MPO does highlight a freight effort on its website. Phoenix retained a consultant to undertake a truck survey for the express purpose of improving the truck component of the MPO’s regional travel demand model. Since the underlying assumption of this study is that MPOs will reflect trucks in their travel demand models in some manner appropriate to the data available to them, surveying trucks for model improvement is not considered a “freight-specific” activity.

Summary statistics of the 70 MPOs listed in Table 1 are presented at the top of Table 2. Planning and demographic information for Boston and seven selected smaller MPOs is also shown at the bottom of Table 2.

As shown in Table 2, on average, the geographically larger MPOs tend to give freight-related activities more prominence. Given that there are a number of large MPOs without freight-specific activities and small MPOs with freight-specific efforts, the size of the MPO, per se, will not necessarily indicate the appropriateness of freight-specific planning at a particular MPO.

The New Orleans MPO offers an important example. The New Orleans region has one-third the population of the Boston region, but is almost the same size geographically. New Orleans does freight planning, one focus of which is intermodal connections. Unlike the Boston Region MPO, however, the transcontinental rail connections and extensive industrial Mississippi riverfront all lay within the MPO region.

The 69 MPOs summarized at the top of Table 2 are on average larger than the Boston Region MPO, which is as expected because this sample was formed from all MPOs geographically larger than Boston. It can be argued, nevertheless, that on average these MPOs are much larger. Even if SCAG, the Los Angeles MPO, is removed from the 14-MPO planning group, that group would have an average size of 4,171 square miles, almost three times the size of the Boston Region MPO.

The advantage of a large geographical extent in freight planning is that industrial and logistics activities that are gradually moving to less dense areas and implementing newer, larger freight systems are more likely to be found in a larger study area. The demonstrably small Boston MPO region has already witnessed the out-migration of key logistics activities, and any MPO freight-planning program should acknowledge this.

Table 2a

Summary of Geographically Large MPO Groups

| MPOs Geographically Larger than Boston Grouped by Activity | Number of MPOs | MPO Group Average Total Population | MPO Group Average Square Miles | MPO Group Average Population/Square Mile |

|---|---|---|---|---|

| Plan freight projects | 14 | 5,399,718 | 6,634 | 814 |

| Study freight issues | 7 | 3,128,576 | 4,255 | 735 |

| Sponsor advisory groups | 6 | 2,306,418 | 3,543 | 651 |

| Work with regional groups | 10 | 467,173 | 3,334 | 140 |

| No freight-specific activities | 32 | 1,185,068 | 3,002 | 395 |

Table 2b

Selected Geographically Smaller MPOs

| Selected Geographically Smaller MPOs | Freight- specific Activity | MPO Size and Density Total Population | MPO Size and Density Square Miles | MPO Size and Density Population/Square Mile |

|---|---|---|---|---|

| Boston, MA | Study | 3,159,512 | 1,458 | 2,167 |

| Louisville, KY & IN | Study | 1,060,541 | 1,419 | 747 |

| Indianapolis, IN | None | 1,518,800 | 1,337 | 1,136 |

| New Orleans, LA | Plan | 1,057,709 | 1,329 | 796 |

| San Antonio, TX | None | 1,763,463 | 1,287 | 1,370 |

| Providence, RI | None | 1,053,527 | 1,193 | 883 |

| Hartford, CT | None | 757,215 | 760 | 996 |

| Portland, OR | None | 1,499,844 | 487 | 3,080 |

The Boston Region MPO travel demand model set is a computer-based tool that depicts transportation activity across 164 municipalities in eastern Massachusetts. The model can depict trips in a recent year or a future year, and can estimate trips by mode, trip purpose, vehicle type, or time of day. Demographic trends are reflected in long-range projections, and effects of changes to the transportation system can be estimated for either near-term or long-range scenarios.

How closely the model results reflect observed travel patterns will depend upon the quality and quantity of available travel data. The model is adjusted to reflect this available data, a process known as calibration. A calibrated model offers several broad classes of transportation insights, including

Vehicle and truck volumes estimated by the model can be invaluable in understanding and potentially solving freight and truck issues. The third model result listed above, “filling in the blanks,” so to speak, is one of the most directly useful results. All truck issues, either investment planning or policy related, should be informed by the numbers of trucks affected. Any question regarding trucks should begin with a review of the numbers of trucks estimated by the model to be operating in the study area. These numbers may be deemed to be appropriately reliable for the investigation at hand, or they may inform targeted additional fieldwork.

The model also estimates the impact of changes to the network such as the numbers of trucks that could be expected to use a weight-restricted bridge after reconstruction. Changes in truck traffic resulting from long-term traffic trends and changes in land use patterns are modeled outcomes that can inform a number of planning efforts.

Preparing the truck components of the regional travel demand model set to support these analyses poses several challenges:

None of these challenges is insurmountable. Indeed, these four circumstances, both individually and collectively, should serve as an incentive to gather data and refine the model set so that the movements of trucks within the overall assigned traffic flows come to more closely reflect actual truck travel patterns.